A key wedge driving the gap between Boston’s affluent and low- and middle-income residents is credit. While good credit opens the door to low-cost loans, poor or no credit can make innumerable life transactions more expensive, from car loans to

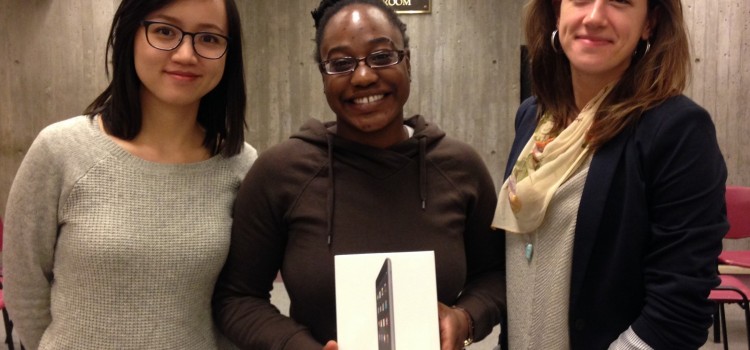

An Innovative New Program to Help Boston Residents Boost Their Credit Scores