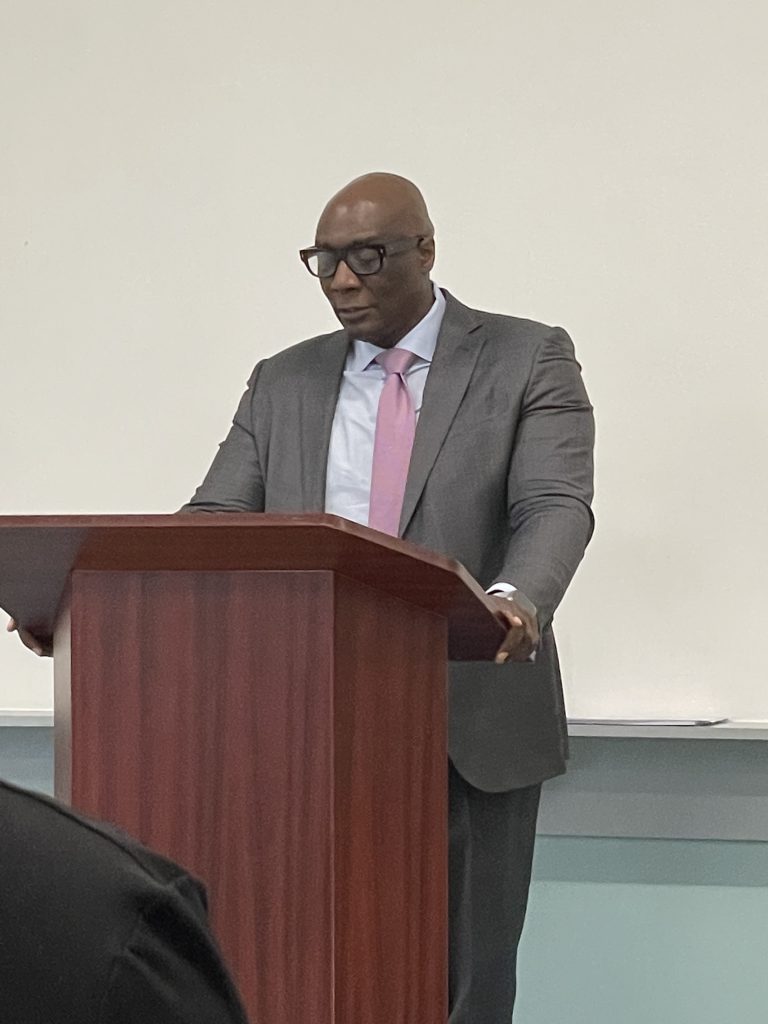

The Boston Tax Help Coalition (BTHC) launched its 22nd season of providing eligible residents with free tax services at a kick-off event held on Friday, January 27, EITC Awareness Day. Boston residents earning $60,000 or less a year can now receive free, quality tax services remotely and in-person at over 30 neighborhood tax sites. The event was hosted at Urban Edge in Roxbury, a BTHC partner. Representing Mayor Michelle Wu and the City of Boston was Chief of Worker Empowerment, Trinh Nguyen. She congratulated the Coalition on its 22 years and recognized the partners and volunteers for their dedication and service.

“The Coalition’s partners and volunteers are IRS-trained and are providing a valuable service to our residents at locations conveniently located in Boston neighborhoods. Congratulations to the Coalition as it enters its 22nd year!” said Trinh Nguyen, Chief of Worker Empowerment.

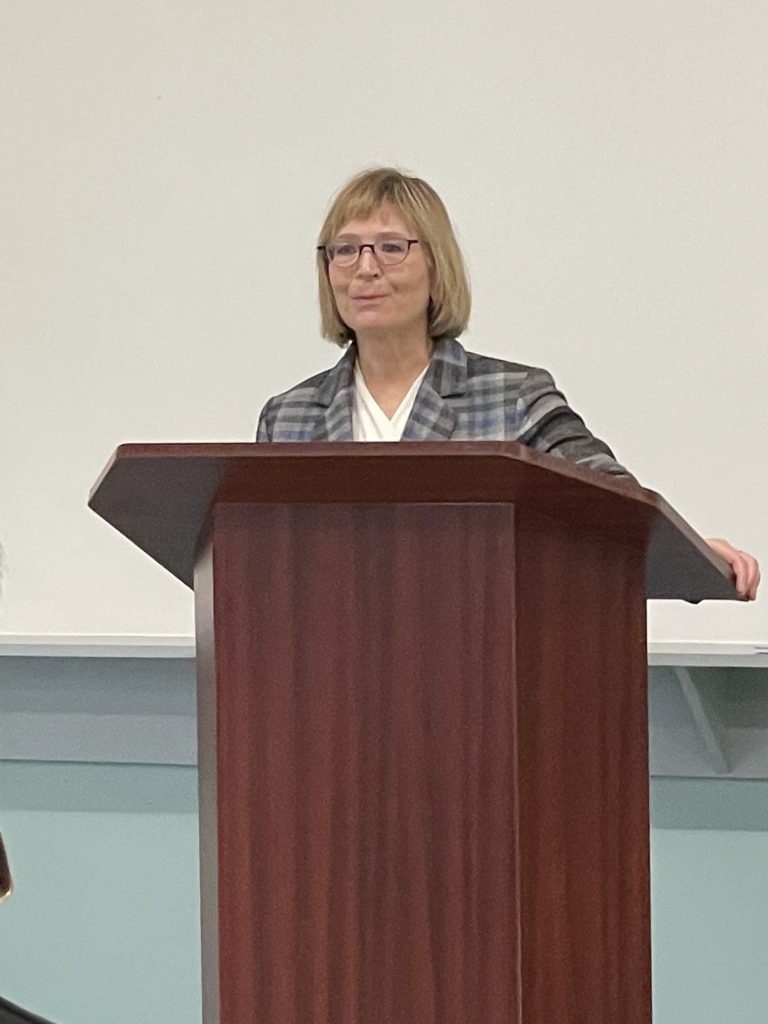

Chief Nuyen also honored Boston Tax Help Coalition Founder Mimi Turchinetz for her leadership and congratulated her on her new role as Assistant Deputy Director of Labor Compliance and Worker Protections in the Worker Empowerment Cabinet.

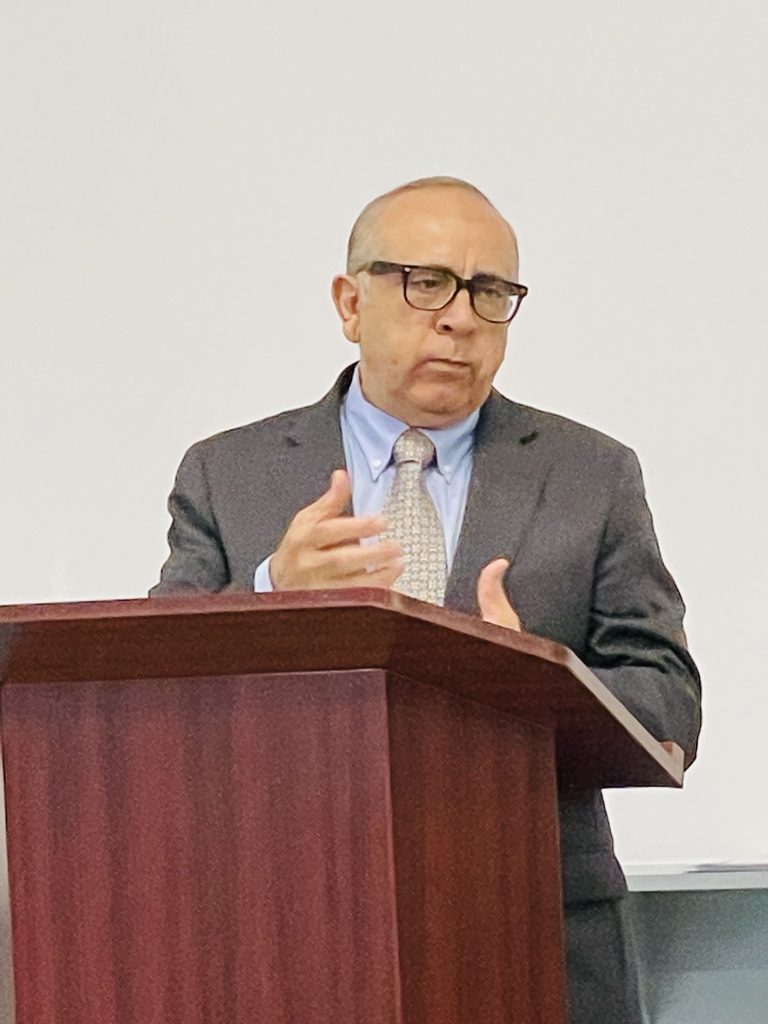

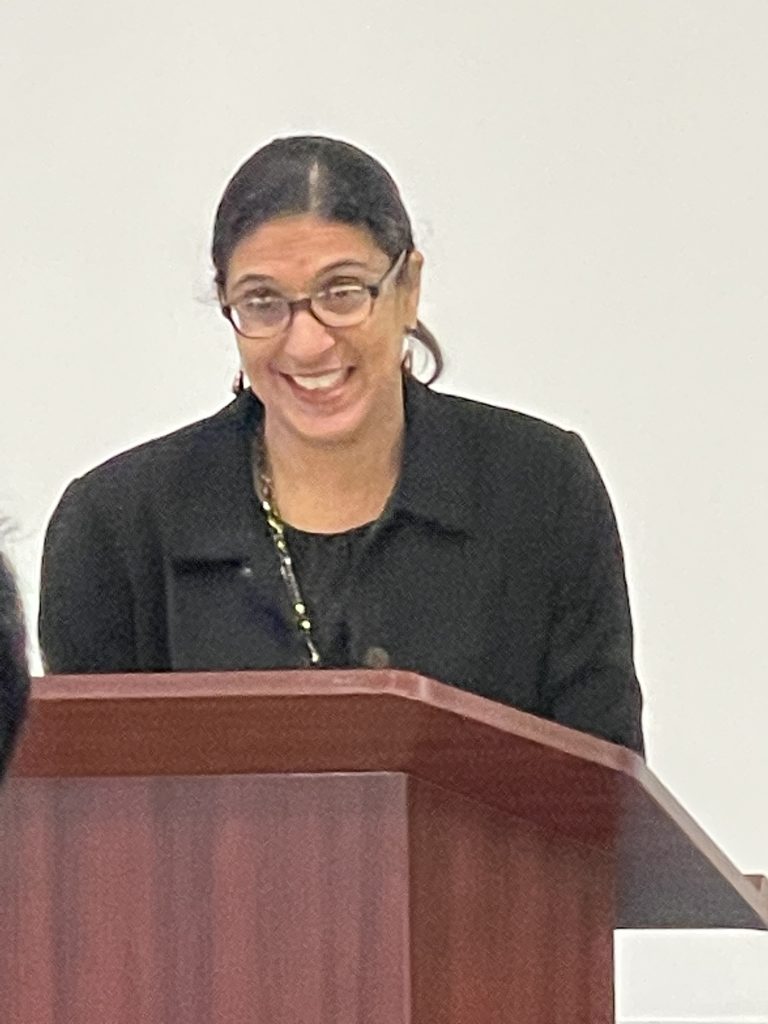

Other speakers included host and CEO of Urban Edge Emilio Dorcely; President and CEO of ABCD, Sharon Scott-Chandler; and two recipients of the free tax preparation services. They all spoke to the importance of this service and the difference it can make in the lives of our low- and middle-income residents. Mencia De Jesus Rivas Soto and Muhamed Elenanzi shared how maximizing their refunds through the Coalition’s free tax services provided a financial boost for their families.

Our partners are especially aware of the impact of this work on our communities.

As ABCD President and CEO Sharon Scott-Chandler said, “Free tax preparation services fight poverty by channeling money directly back into the hands of residents and under-resourced communities.”

Urban Edge CEO Emilio Dorcely echoed this sentiment, saying, “Often, receiving a tax refund is people’s first step toward household budgeting and building family wealth. As part of the Boston Tax Help Coalition, Urban Edge has been a trusted and reliable place where hundreds of families in Roxbury and Jamaica Plain can go for free tax preparation and filing services each year.”

The program allows residents to keep more of their earned income and maximizes the impact of their tax credits by eliminating tax preparation fees. IRS-trained tax preparers also assess filers’ eligibility for the Earned Income Tax Credit (EITC), a credit for low- and middle-income workers, and the Child Tax Credit (CTC). Both credits greatly reduce poverty for working families by providing a financial boost.

Although Mayor Michelle Wu could not attend the launch, she sent best wishes and acknowledged the importance of the Coalition’s free tax preparation service and encouraged eligible residents to take advantage.

“Boston residents can save hundreds of dollars per household through the Boston Tax Help Coalition’s free tax preparation,” said Mayor Michelle Wu. “These free, multilingual tax assistance services are available across thirty locations and remotely serve as a valuable resource that supports thousands of Boston residents in maximizing their refunds safely. I encourage every qualified Boston resident to take advantage of this model program.”

Find more information about the Boston Tax Help Coalition’s free tax services and tax sites at bostontaxhelp.org.

Read the City of Boston press release.